Talking to children about money

A couple of weeks ago, the kiddos and I were talking about buying a new trampoline. The middle two had both saved up some money to put towards one, and I said that I would pay the rest. Beastie wandered off and came back with his purse. He sat at the table and tipped out the money he had – all £6.67 of it, gave it to me and said he would buy the trampoline with his money all by himself.

It was super sweet, and he was so happy to be buying a trampoline himself. At three, he knows that we need money to buy things, but hasn’t quite got to grasps with the wider concept of how much things cost, and how much coins are worth. I remember the girls being the same at his age. I’ve always talked to the kiddos about money and about how much things cost, I think giving our children a good financial education is an essential part of parenting.

Growing up, I don’t really remember being spoken to about financial matters, and like a lot of teenagers, once I had my own first paying job, I spent, spent, spent. Looking back, I think if I’d had more of an awareness of money matters, I would have done things differently.

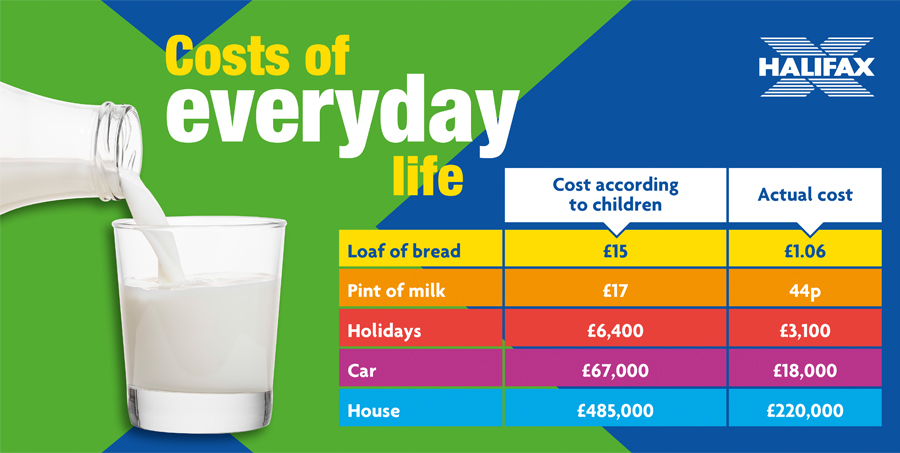

So many children don’t really have a grasp of just how much things really cost. The Halifax have recently conducted their annual pocket money survey, they asked 4000 parents and their children (aged 8-15) various things about money. The findings were quite surprising to me –

- Most children think they’ll be millionaires when they’re older (boys think they’ll be richer than girls)

- They’re way off the mark with the cost of everyday items – they think a loaf of bread costs £15, pint of milk £17, car £67k, school uniform £180 (but did you know the average cost is £213?!)

- They think that teachers earn a £110k salary, Prime Minister £3 million, doctor £270k

- They’d rather be rich than famous when they’re older – though a quarter of kids shun both of these things

- They want to retire at the age of 56

I asked mine how much they thought things cost, and thankfully they were much closer to the cost of bread and milk – though they had no idea on school uniform as they don’t go to school. I involve the children to a certain extent in our family budgeting, talking to them about costs of items, how much we spend on shopping, etc. We talk about saving up for things that we want, or not doing certain things because we need to spend the money on x, y or z. I think it is vital that they get an understanding of how the financial world works from being little, so when they are older they can manage their own budgets.

My biggest two both have bank accounts, where I pay in their pocket money each month. When they were younger they both wanted to spend any money they had as soon as it was in their hands, and for a while, I gave them cash each week for their pocket money. This seemed to lead to them spending each week’s money on little things and not saving.

Since we switched to monthly pocket money payments in a bank account, they have both got so much better at saving for bigger items, thinking about what they are buying and budgeting so that they don’t spend all of their money at the start of the month. I also encourage them to save a small percentage of their pocket money, and any other money they get given each month – trying to instill in them the importance of regular savings!

My kiddos also all have set chores that they are expected to do in exchange for their pocket money each month – I think it is good for even little children to understand that money isn’t just given to us. As I work from home, I often talk to them about me needing to sit down and do some work so that I earn money to pay our bills, buy food and do fun things.

The Halifax shared their five tips for talking to your children about money:

- Encourage the savings habit from a young age: use a piggy bank or savings jar to make savings fun.

- Give them pocket money: teach them to manage their money by giving them a regular income from pocket money in return for doing chores.

- Open a regular savings account: this will help children understand about saving, interest and how to manage an account.

- Talk to your children about bills: when you receive bills, this can be an opportunity to explain all the different things that cost money and how you use your earnings to pay for it.

- Get them involved in managing the family purse strings: take them to the supermarket and get them involved to help them build an appreciation of the cost of everyday items.

1 Comment

Leave a Reply

You must be logged in to post a comment.

McKenzie Allyshia

May 27, 2018 at 05:32I love this post so much! You touch on so many wonderful points. When I first got my job at our local credit union, I had to take classes and classes on finances and became a certified financial counselor. This quickly prompted me to talk to and teach my son about money. When we go to the store and he asks for an item, I make sure he tells me the price. Then I let him know how much we have to spend and that (most of the time) we have more important items that we need to buy. Plus, like you mentioned in your post, his earnings go straight to his bank account. Very, very rarely does he ask to take money out. Most of the time he will mention he really wants to buy a toy and I will tell him to wait one month and see if he still wants it. If he does, we will look into getting it. However, 99% of the time so far he has forgotten about the item or toy he wanted.